The podcast industry is entering a new phase of maturity, with a marked slowdown in organic growth, according to the latest Podcast Landscape report from Sounds Profitable.

This year’s report is billed as the largest publicly-available study of podcast consumption in the U.S., with a sample of over 5,000 Americans, 18+.

It highlights a slowdown in overall growth, with the percentage of Americans who have “ever consumed” a podcast increasing only slightly from 72% to 75% over a three-year period. The data reveals that growth seen over the last year has been primarily driven by multicultural audiences, with numbers for Asian and Black Americans showing particular gains. White respondents only account for 52% of total monthly podcast consumption, while 65% of Hispanic Americans partake, 62% of Black audiences, and 66% of APAC (Asia-Pacific) audiences.

The average weekly time spent with podcasts has risen from 6 to 6.3 hours, directly linked to video consumption. YouTube has become the top platform for podcast consumption, with 40% of users naming it their go-to. However, the data challenges the assumption that YouTube is strictly a video-first platform for podcasts.

“Just under half of YouTube podcast consumers…say that they listen more than they watch,” said Sounds Profitable partner Tom Webster. “This suggests that consumers are embracing the flexibility of the medium, choosing to listen to content even when a video version is available.”

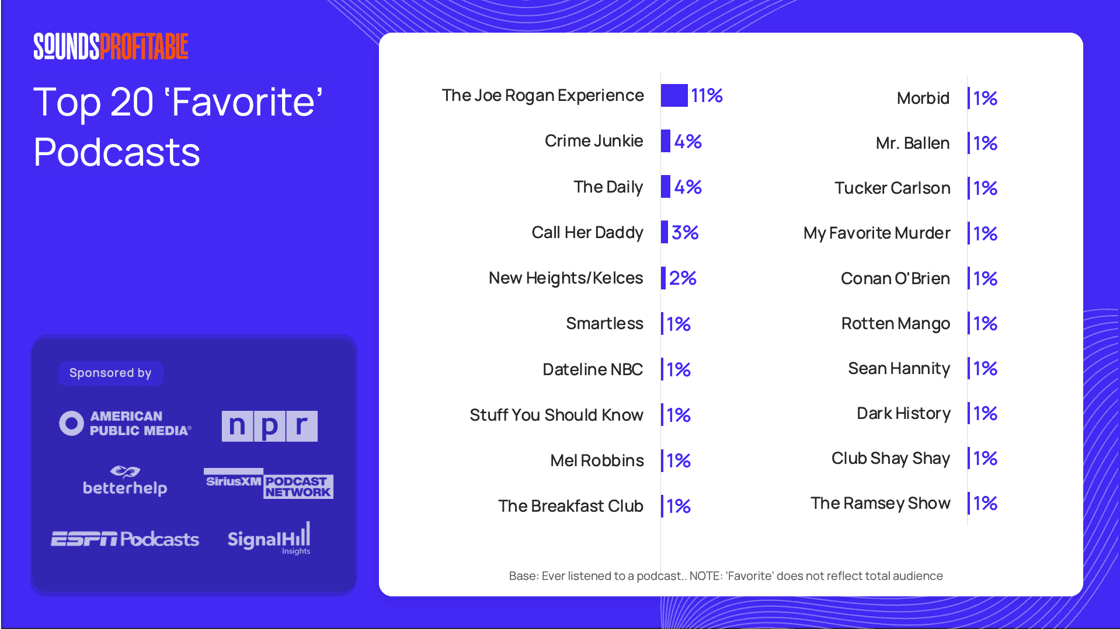

The report also found that audiences are becoming more fragmented. While the Joe Rogan Experience remains the most popular podcast (moving from 13% of respondents who cited it as their favourite to 11%), there are signs of erosion as the gap between it and the next three most-loved shows – Crime Junkie, The Daily, and Call Her Daddy – shrunk from 11 percentage points to seven. Webster said this finding, along with a four-point year-over-year increase in interest for news and political analysis, points to a diversifying audience no longer dominated by a few key shows.

“I submit that that’s a healthy thing,” Webster said, emphasizing that the shift to a more varied landscape will benefit the industry as a whole.

Comedy, news and sports remain the milieu’s top genres, according to the study.

“The podcast space is maturing,” he continued. “Organic growth has slowed, which means I think we need to market ourselves a little bit more.”

Webster is suggesting a new approach for the industry, urging some of the bigger shows and celebrity hosts to “talk more about the medium” and promote a wider variety of podcasts to new listeners.

Other study findings include that while smartphones are still dominant as a podcast listening device, smart TVs are a growing go-to for consuming podcasts (9%), often via YouTube.

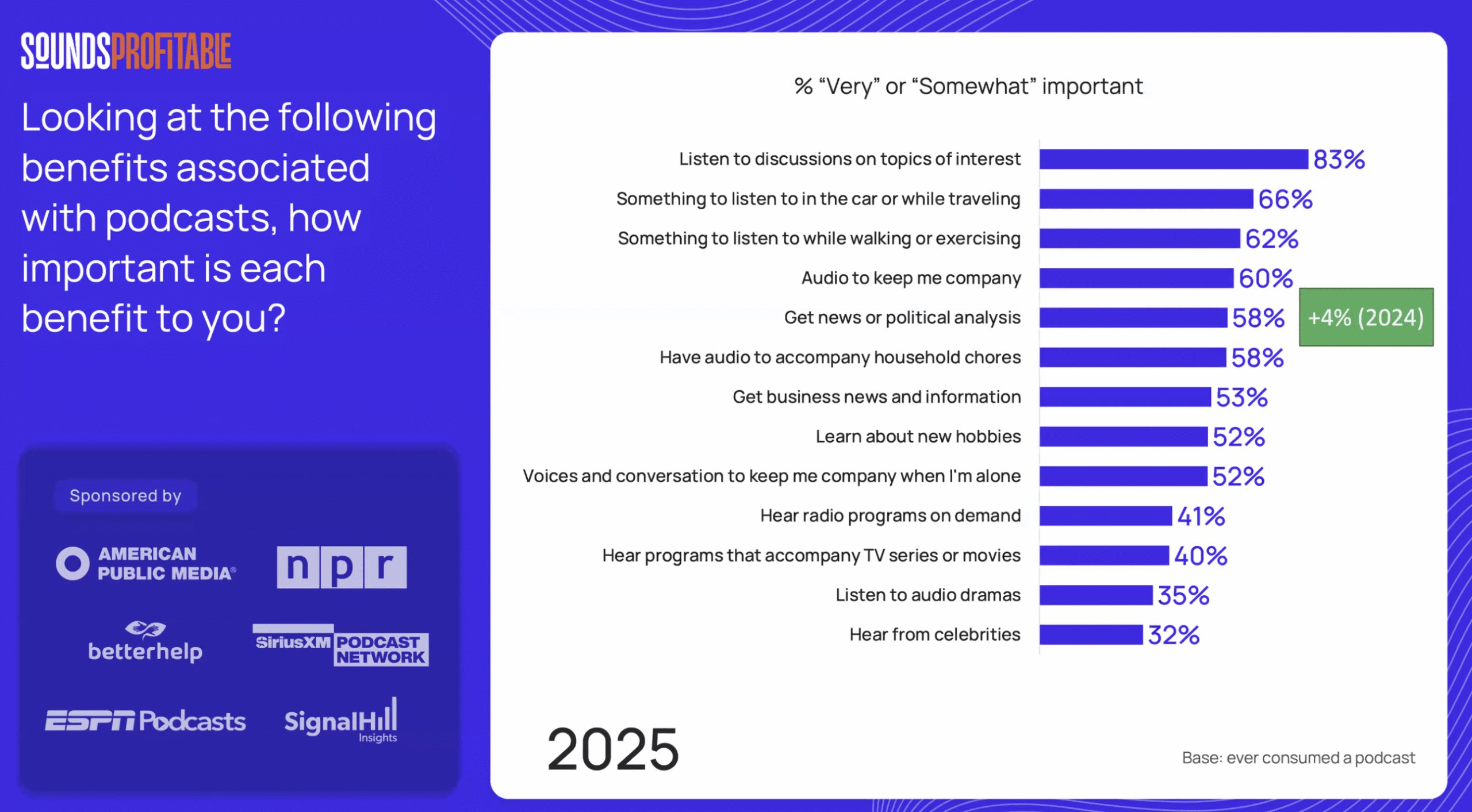

Webster also noted that the main reasons people cited for listening to podcasts were for discussions on topics of interest and companionship during chores or travel. Hearing from celebrities was deemed a low-priority benefit.

“…this has been true the last three years. Hearing from celebrities ranks the lowest, and I would encourage entities out there, that are putting together new ventures, new shows, new efforts into the space…certainly there are celebrity podcasts that work because those celebrities are excellent at what they do,” said Webster.

“Not only is it not a guarantee of success, it’s pretty low on what people are looking for, and yes, it might get some buzz. It might get some success, but it’s not enough,” he concluded. “People are looking for companions, they’re looking for information on topics that interest them, they’re looking for hobbies, they’re looking for business news, they’re looking for political news, they’re looking for true crime.”

Sounds Profitable will be releasing a second part to the study, focused on discoverability and churn, in the coming months.